Battle of the AI Tech Giants: Has Apple Outperformed Google and Microsoft?

Modern AI tech giants are battling for dominance among a rapidly growing industry. Beginners like OpenAI are carving out a unique space while traditional tech companies like Apple, Google, and Microsoft continue to fight for dominance among each other in the evolving artificial intelligence landscape.

So, who’s winning the war? Apple has recently garnered significant praise for its distinctive approach to AI, further complicating the answer to that elusive “winner” question. As we dive into Apple’s strategy and compare it to other major competitors in the traditional big tech giant space, start to formulate your own opinion on what constitutes winning in AI – adherence to privacy, ethical boundaries, or strong financial ROI.

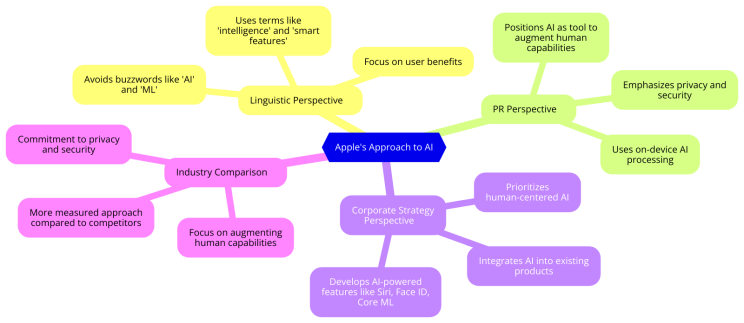

Apple’s AI strategy: A privacy-centric approach

Apple’s AI strategy diverges significantly from its peers by placing a premium on user privacy. While its rivals, Google and Microsoft, depend heavily on cloud-based data processing—an approach that involves extensive data collection and analysis—Apple has taken a bold stand with its on-device computation strategy.

This commitment to privacy is deeply intertwined with Apple’s overarching philosophy of safeguarding user data. By processing data directly on users’ devices rather than sending it to the cloud, Apple effectively mitigates the risk of data breaches and fortifies user trust. This approach resonates especially in an era where privacy concerns are intensifying, making Apple’s stance a significant differentiator in the AI research and development space.

[Image Source: Daniel Maley, LinkedIn]

Apple’s privacy-first strategy is also about aligning with a broader trend towards data protection. With increasing scrutiny from regulators and growing consumer awareness about data privacy, Apple’s emphasis on on-device processing underscores a vital shift in artificial intelligence development. This approach is likely to appeal to users who are increasingly wary of pervasive data collection practices.

Moreover, Apple’s AI strategy is intricately linked to its hardware and software integration. Unlike Google and Microsoft, which are more focused on cloud services and external hardware, Apple embeds AI capabilities directly into its range of devices—from iPhones and iPads to MacBooks and Apple Watches. The company’s A-series chips, designed with machine learning accelerators, showcase this integration, boosting performance in tasks like image recognition and natural language processing, and AI agent functionality.

This seamless integration allows Apple to optimize AI functionalities across its entire ecosystem. By aligning hardware capabilities with software advancements, Apple delivers a more cohesive and efficient user experience. This strategy not only improves device performance but also reinforces Apple’s position in a competitive market where integration and user experience are key differentiators.

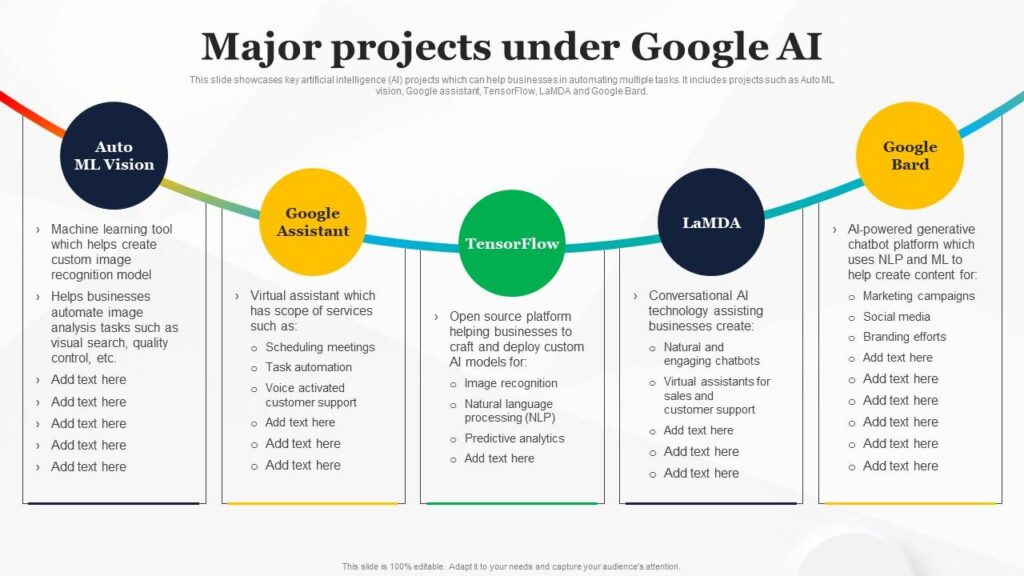

Google: Expanding AI horizons with cloud and hardware innovations

Google’s AI strategy is marked by its ambition to integrate advanced capabilities across both consumer and enterprise markets. Through initiatives like the Gemini AI assistant and Project Astra, Google aims to embed AI deeply into its core products, including the ever-evolving Google Search. At the same time, the company is pushing boundaries with its Tensor Processing Units (TPUs), a specialized hardware designed to accelerate machine learning tasks in the cloud.

[Image Source: Slideteam]

Despite these innovations, Google faces the complex task of balancing AI integration with maintaining a positive user experience. The challenge lies in ensuring that AI enhancements, particularly those integrated into legacy products like Search, enhance rather than disrupt user interactions. Google’s expansive approach reflects its broader goal of leveraging AI to drive technological advancement, though it must navigate the intricacies of user experience and integration challenges.

Microsoft: AI-driven productivity and cloud services

Microsoft’s AI strategy is centered around enhancing productivity and cloud-based solutions. With initiatives like Copilot and Microsoft Cloud, the company leverages its robust presence in enterprise solutions to push AI adoption. By embedding AI into familiar software products and cloud services, Microsoft aims to improve business efficiency and drive innovation in the workplace.

This focus on productivity tools and cloud services positions Microsoft as a formidable player in the business sector. Its strategy capitalizes on a broad user base and extensive software ecosystem, making generative AI an integral part of its enterprise offerings. By integrating AI into Microsoft Office and other productivity applications, the company aims to streamline workflows and boost performance, thus reinforcing its strong market position in the business domain.

Market share and growth potential of the AI tech giants

Microsoft is embedding AI into its suite of popular software products and leveraging its cloud infrastructure to provide AI-driven tools to business customers. Microsoft’s AI, integrated into offerings like Microsoft Copilot and Azure, represents a strategic push to enhance productivity and business efficiency.

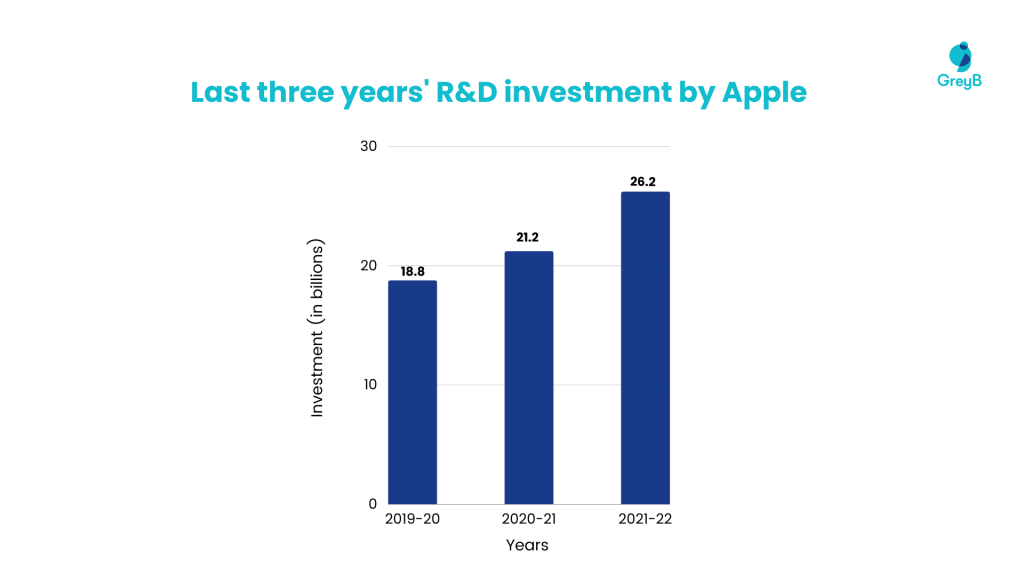

Apple, in contrast, is initially positioning AI as a tool to drive sales across its hardware ecosystem. By integrating AI features directly into its devices, Apple aims to leverage its extensive installed base and brand loyalty. This approach not only enhances user experience but also reinforces Apple’s market position as a privacy-centric tech leader among tech companies.

[Image Source: GreyB]

Google is taking a dual approach by transforming its flagship product, Google Search, into an AI-powered service while also advancing into AI hardware with its Tensor Processing Unit (TPU). Additionally, Google is integrating its AI assistant, Gemini, into its productivity tools, aiming to compete directly with Microsoft’s Copilot.

The conversational AI market was valued at $7.6 billion in 2022, with expectations for a compound annual growth rate (CAGR) of 23.6% from 2023 to 2030. This growth suggests significant revenue potential, projected to reach $48.81 billion by 2031.

Apple’s robust device ecosystem and emphasis on user data protection position it well to capture a substantial share of this expanding market. Microsoft’s focus on business applications also places it in a strong position, provided Copilot becomes indispensable for Office users. Google’s strategy, while ambitious, remains uncertain, particularly as it integrates AI into Search—a move that could risk brand reputation if users find the changes unwelcome.

Risks for the tech giants in the AI sphere and long-term outlook

The regulatory landscape for AI is evolving rapidly. The Stanford University AI Index Report highlights a surge in AI-related regulations, from just one in 2016 to 25 in 2023. This growing regulatory scrutiny may drive up development and operational costs for AI providers, complicating their ability to innovate and scale.

Moreover, the pace of AI advancement is outstripping user familiarity and expectations. The initial excitement surrounding AI’s capabilities may wane as users encounter inconsistencies and limitations. The rapid development cycle could lead to obsolescence and shift demand toward newer solutions, leaving early innovations behind.

The financial burden of developing advanced AI models is substantial. Training models like OpenAI’s GPT-4 and Google’s Gemini Ultra have required investments of $78 million and $191 million, respectively. These high costs assume that the models will deliver substantial returns before becoming outdated.

Despite the inherent risks, the future of AI appears promising. Grand View Research projects a CAGR of 36.6%, with annual revenues expected to soar to $219 billion by 2030, up from $55.82 billion in 2024. This growth will necessitate substantial upfront investments, with Goldman Sachs forecasting annual AI investments could reach $200 billion by 2025.

Investors, ever forward-looking, are already pricing in this future growth, leading to volatility as market conditions fluctuate. The proactive investment in AI reflects a broader belief in its transformative potential, even as the sector navigates the challenges of rapid evolution and high costs.

Apple vs. Google and Microsoft: Final verdict of AI showdown

Apple’s AI strategy stands out for its emphasis on user privacy and seamless hardware-software integration. While Google and Microsoft have strong AI initiatives and substantial market presence, Apple’s approach offers a unique value proposition that aligns well with current user concerns about data privacy and integrated user experiences.

Overall, Apple’s privacy-centric AI strategy, coupled with its robust device ecosystem, positions it advantageously in the evolving AI landscape. However, each company’s approach has its strengths, and the competitive dynamics will continue to shift as AI technology advances and market demands evolve.

Moreover, as the AI landscape continues to develop, Apple, Google, Microsoft and Meta will each play crucial roles, leveraging their unique strategies and resources to shape the future of technology.

In brief

Apple’s AI strategy, characterized by a focus on privacy, seamless integration, and user experience, positions it as a strong competitor in the AI landscape. While Apple may not yet match the breadth of Google’s or Microsoft’s AI initiatives, its distinctive approach provides a competitive edge. By prioritizing on-device AI and integrating advanced features into its hardware ecosystem, Apple has carved out a unique position in the market.